Understanding the Types of Trends in the Stock Market

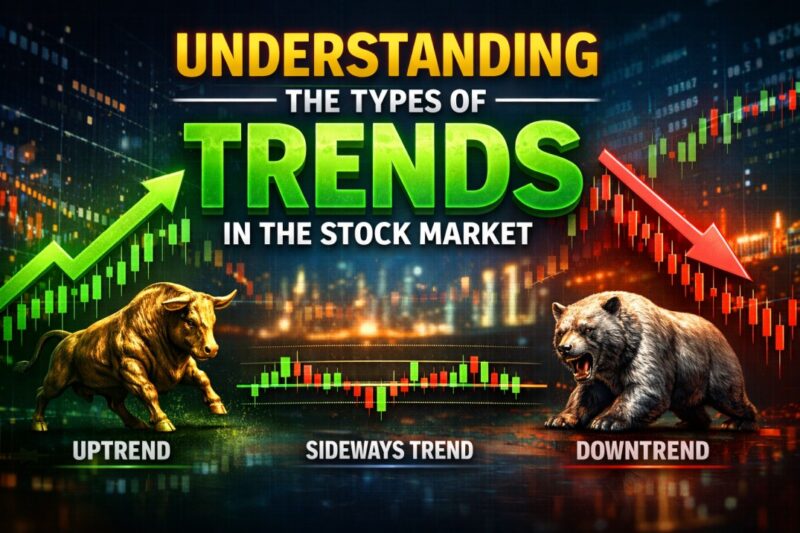

When you take a deep look at the stock prices’ movement, you’ll find that the prices move in quite random ways. Most often, these changes follow a steady path for a specific period before making the major change. This constant phase of stock price is known as a “Trend”, highlighting the general direction of prices over time.

The trends in the stock market can go up, down, or remain flat. If we check the recent news, Asian stocks hit high levels, highlighting a strong upward trend. At the same time, some reports also showed the stable phase of Indian markets, showcasing a sideways trend for a short week.

The ability to spot these trends as per stock price will give you a better understanding of the market.

Uptrend (Bull Market)

An uptrend (Bull Market) is when the stock prices rise over time. In this phase, you can find every new peak steeper and higher than the previous one. Similarly, every dip remains higher than the one before it.

This phase exhibits a gradual rise rather than sudden peaks in the graph. Although the prices might slow down or pause at certain times, the main direction remains pointed upward.

Here is a simple Uptrend example to illustrate that prices continue to rise over time.

| Day | Price |

| Day 1 | 100 |

| Day 2 | 105 |

| Day 3 | 110 |

Downtrend (Bear Market)

A downtrend (Bear Market) functions exactly opposite to an uptrend. You will see the prices getting lower with the passing time, with each dip getting below the previous ones.

Downtrend basically highlights the slow downfall rather than a sudden crash. You might find some small rises here and there, but the overall path stays pointed down.

Here is an example pattern highlighting a clear downtrend over time.

| Day | Price |

| Day 1 | 120 |

| Day 2 | 115 |

| Day 3 | 108 |

Sideways Trend (Range-Bound Market)

A sideways trend (Range-Bound Market) occurs when stock prices trade within a specific range. There won’t be any clear highs or lows in this phase. However, the price trends will more likely bounce between high levels and low levels without a breakout.

Here is an example range showing locked prices between two flat levels for a defined period.

| Level | Price |

| Upper Range | 105 |

| Lower Range | 95 |

Long-Term Trend

A long-term trend (Secular Trend) occurs over several years, highlighting the general direction of the stock market, with a look at the past temporary noise.

These trends are constant and don’t change much due to daily price swings. In reality, the long-term trends usually have small and medium price moves hidden inside them.

Intermediate-Term Trend

An intermediate-term trend usually lasts from several weeks to a couple of months. This trend serves as a bridge between quick and daily changes.

You will find this trend in the stock market while market prices adjust before resuming the main direction. In simple words, intermediate-term trend represents a medium-scale phase of market activities that helps in defining the broader picture.

Short-Term Trend

A short-term trend usually lasts between a few days and several weeks. These stock price movements happen very quickly and shift often in comparison to larger cycles.

You can see these quick trends happening between medium and long-term price movements. These are minor fluctuations with no major impact and even move in opposite directions briefly.

Trend Phases Within Market Movement

Every market trend we discussed flows through specific stages over time. These phases check how price action moves from the beginning to the end.

These steps highlight how the move begins, gains strength, and finally fades away. The cycle keeps repeating after a trend finishes and a new path begins.

| Phase | What Happens |

| Start | Price begins to move in a direction |

| Middle | Movement becomes clearer and steady |

| End | Movement slows or starts changing |

Trend Reversals

A trend reversal happens when the price movement path flips. For example, a rising trend can move downward ot flat state market can suddenly rise. However, the trend reversals can be so sudden that they take time to develop.

Trend Continuation

Trend continuation happens when stock prices maintain their original direction before taking a minor break. The momentum might dip for a short moment, known as “flags” or “pennants”. These patterns showcase healthy movement with enough energy to keep moving ahead.

Conclusion

Hence, market trends highlight the stock price movement over time. While some trends move up, slide, or remain flat within a range, these might overlap or coexist with each other. With a clear understanding of trend behavior and layers, it becomes easier to observe market movement.

For More Information: Download Stockyaari App Now

Standard warning: “Investment in securities market are subject to market risks. Read all the related documents carefully before investing.” Disclaimers: a. “Registration granted by SEBI, enlistment as RA with Exchange and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.” b. “The securities quoted are for illustration only and are not recommendatory.”

This analysis is for informational purposes only. Please consult a SEBI-registered financial advisor before investing.

– Chandan Pathak

Equity Research Analyst, StockYaari